Venture Capital has a gender gap. What will you do to help close it?

You can't manage what you don't measure – so we measured it. We gathered data on over 300 venture capital firms and corporate venture arms across Canada and the USA to try to paint a clearer picture of the state of gender in venture capital.

This is about more than uncovering the data behind the problem. It's about giving institutions and individuals the information we need to understand where we're at, and take action.

As you read this year’s report, we urge you to consider: How will you take action to change who is at the table?

Where are the women in venture?

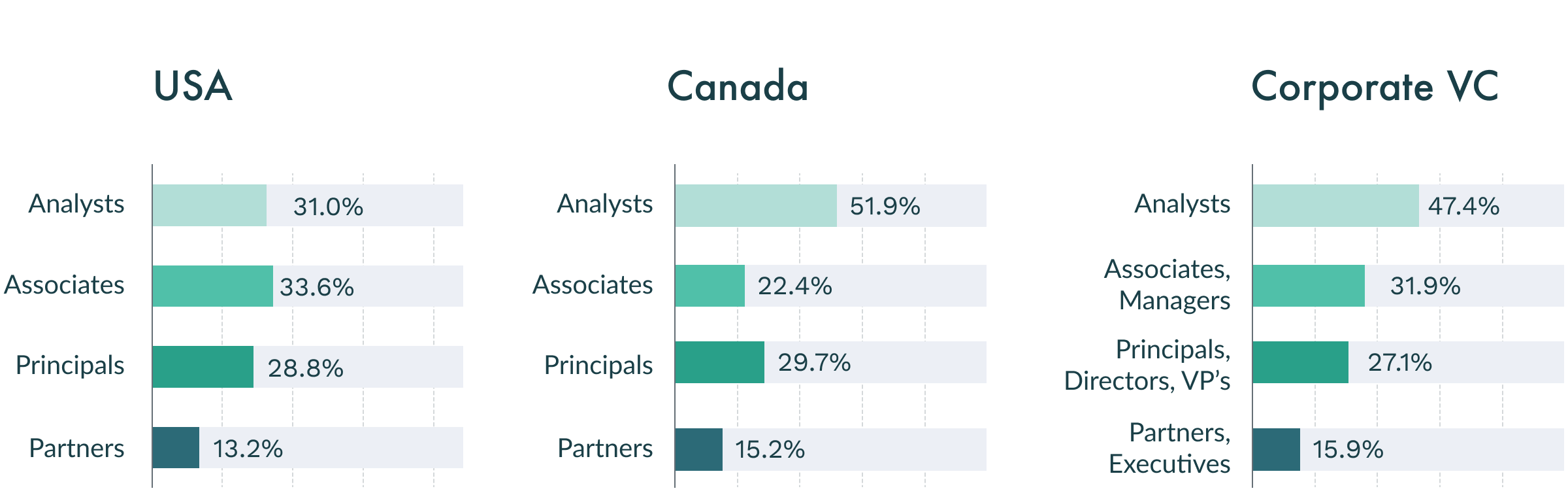

As seniority increases, representation drops

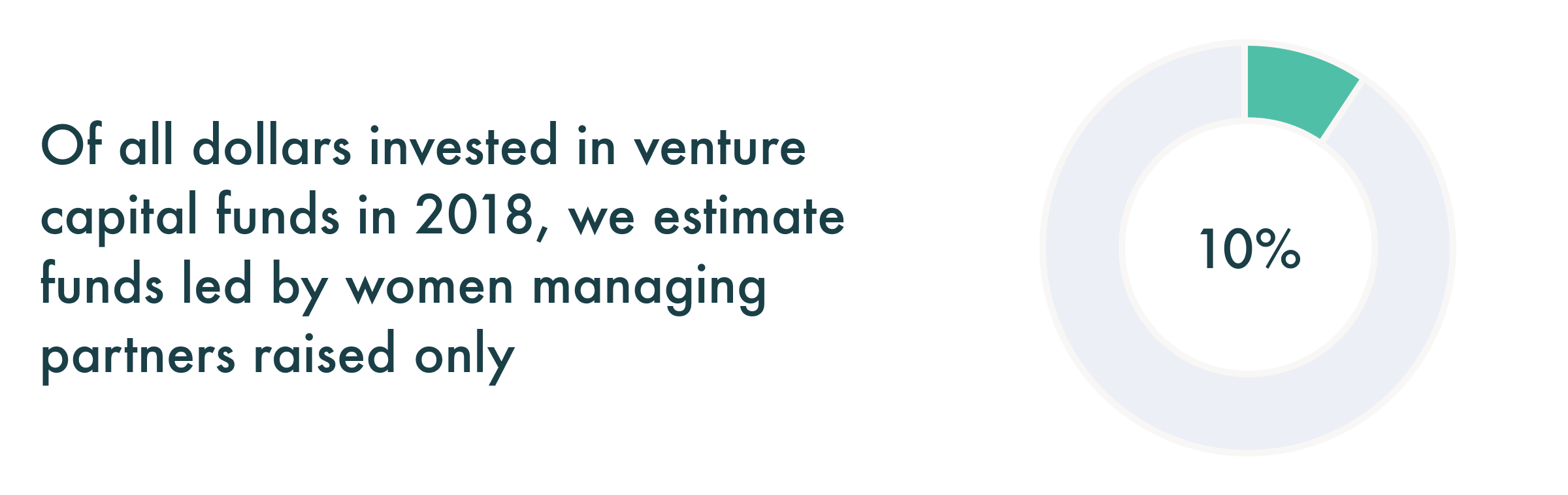

Most venture capital in Canada and the USA is controlled by teams with all-male managing partners

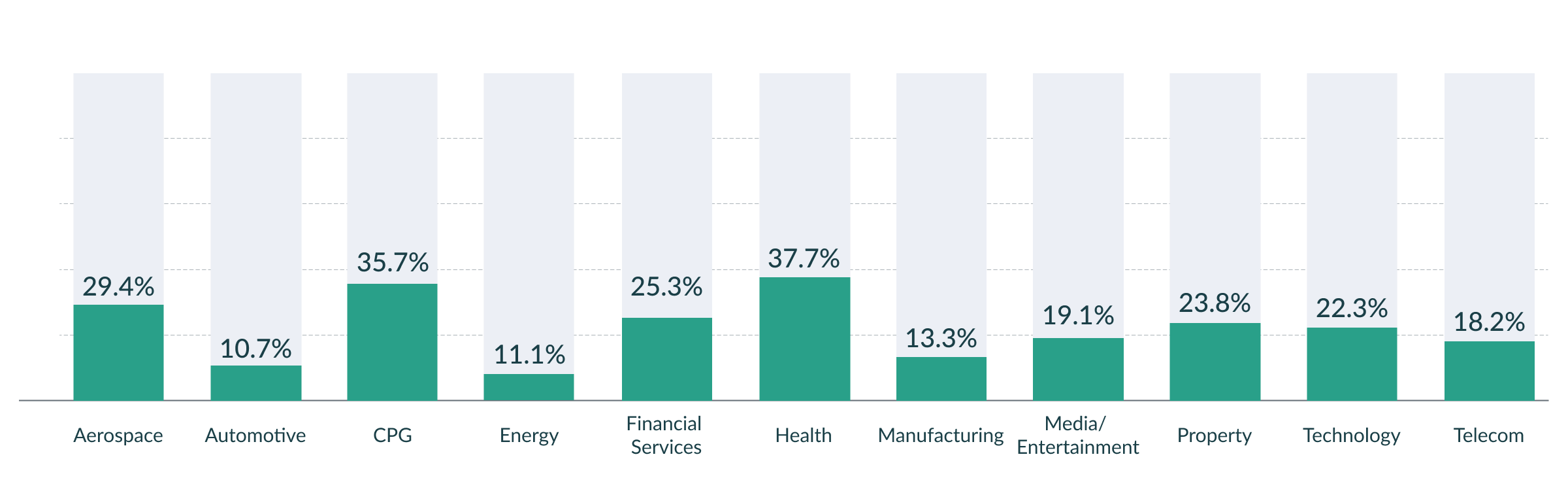

Representation of women on corporate venture capital investment teams varies widely by industry

Percent of total investment team roles held by women, by industry: