Women in Venture Report 2018

A baseline look at gender in the Canadian investment ecosystem

See the most recent report here.

Introduction

Today, women are starting businesses at a faster rate than ever before, and leadership teams that include women provide better financial returns for investors. Investing in women is good for business.

Canada has taken a strong leadership role in championing the next generation of women founders, yet access to capital remains a major barrier for women looking to launch and scale successful businesses.

Investors, accelerators, and policy makers all have a role to play in driving change for the next generation of entrepreneurs, and for Canada. Without representation on both sides of the table – among both entrepreneurs and investors – we won’t see real change.

This report represents the beginning of a project we’ve undertaken to understand one important piece of the puzzle: who is on the other side of the table?

There is consistent data showing that deal flow is often sourced from pre-existing networks. This helps to explain why women entrepreneurs have a higher likelihood of closing investment when a female investor is involved: venture firms are twice as likely to invest in women-led startups if they have at least one female partner on their team, and women angels place greater importance on the gender of the founders they are considering investing in.

In short: women entrepreneurs are more likely to access capital when there are women making investment decisions, too.

You can’t manage what you don’t measure — so we measured it.

Throughout my work at both Female Funders and Highline BETA, I often find myself on panels or in private conversations where I am asked about why there are not more women investors in our ecosystem, and how to drive sustainable change for a more diverse and inclusive industry.

Until now, my colleagues and I have been forced to reference data that is outdated, incomplete, or US-centric.

In partnership with Hockeystick and the National Angel Capital Organization (NACO), we have set out to highlight baseline data on women in venture in Canada.

This is only a snapshot of women in venture capital. We look forward to tracking the trends we see, and working to help improve the entrepreneurial and investment landscapes for women over time.

If Canada’s venture ecosystem is going to drive change, first we need to know where we stand.

- Lauren Robinson Executive Director, Female Funders General Partner, Highline BETA

Methodology

Venture Capital Firms

To better understand the makeup of the decision-makers in Canadian venture capital, we looked at 33 Venture Capital Firms that either made investments in 2017 or announced the close of a fund in the last 12 months. Using firm websites, LinkedIn, and Crunchbase data we recorded the titles of over 300 team members in an attempt to understand the makeup of the teams at these firms.

Angel Groups

With the help of NACO (National Angel Capital Organization), we looked at the self-reported makeup of the membership of 22 Angel groups across Canada in 2017. While not a comprehensive look at Canada’s angel investors, this initial data gives us a snapshot into the makeup of the groups providing the make-or-break capital for so many entrepreneurs.

Investors, accelerators, and policy makers all have a role to play in driving change for the next generation of entrepreneurs, and for Canada. Without representation on both sides of the table – among both entrepreneurs and investors – we won’t see real change.

Gender in Canadian Venture Capital

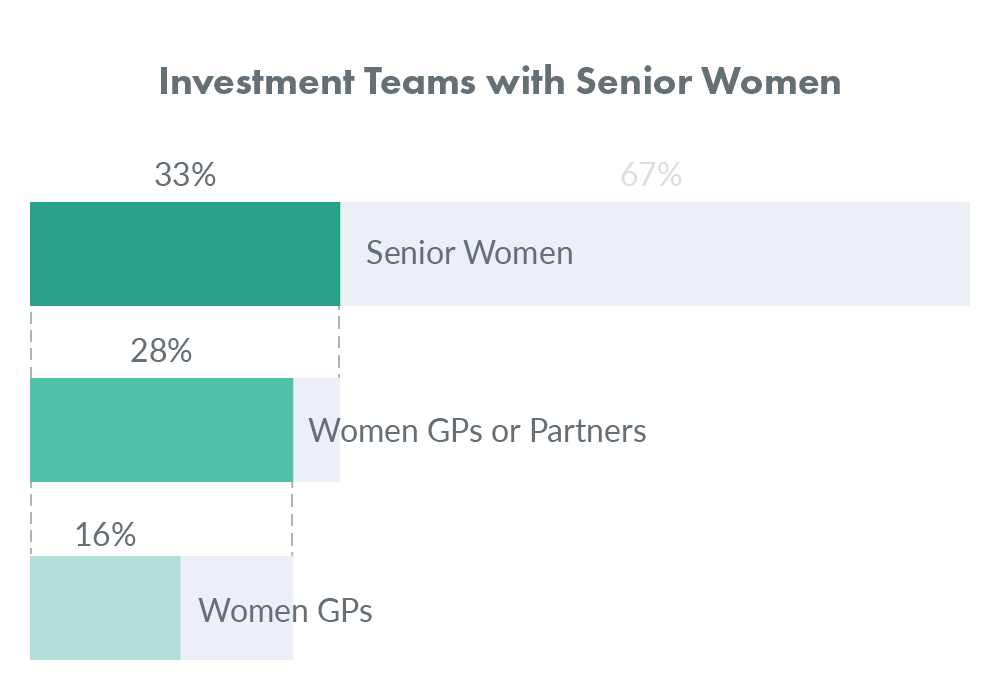

With each step up the “staircase” of seniority, representation of women is cut in half.

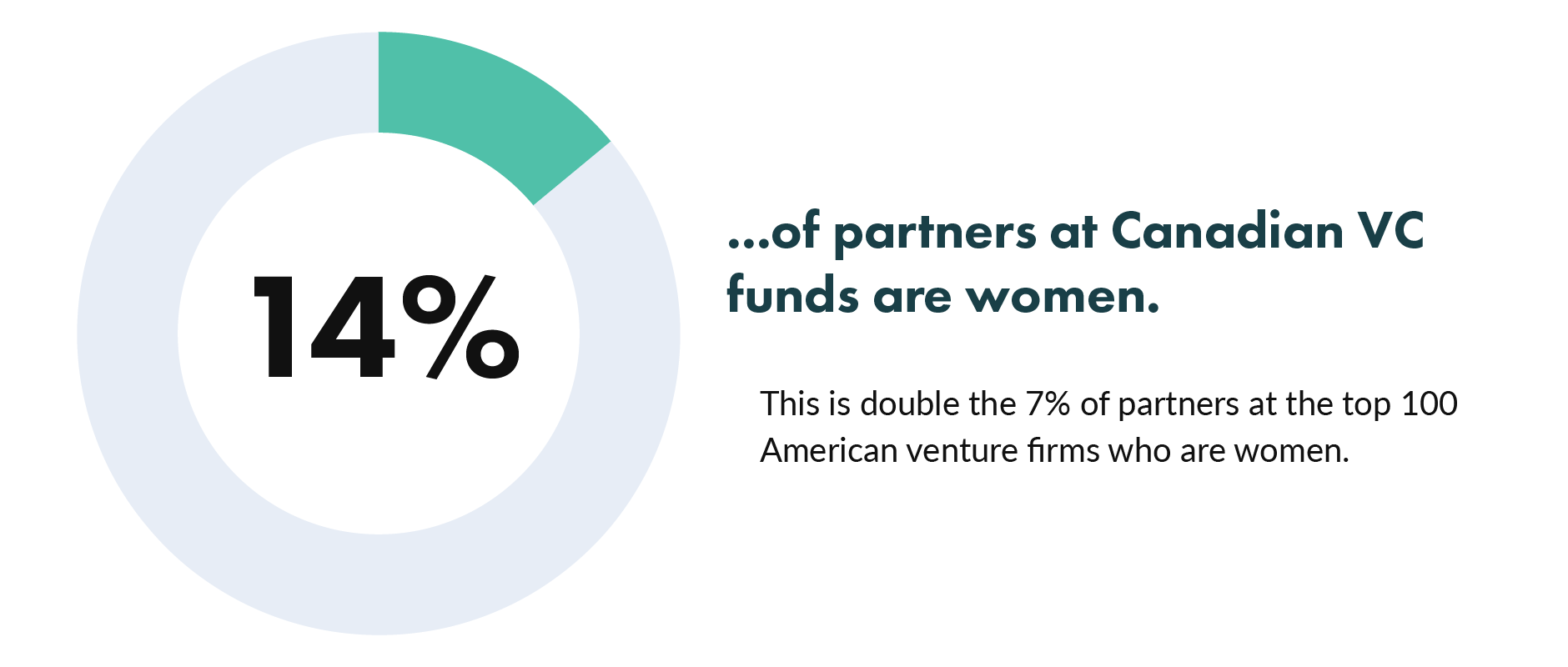

Women hold 58% of all analyst roles, 27% of all associate and principal roles, and represent just 14% of all GPs and partners.

Most VC dollars are controlled by investment teams with no senior women.

67% of all the dollars committed to funds are controlled by investment teams with no senior women at all. 84% of the dollars committed to funds are controlled by funds with no women GPs.

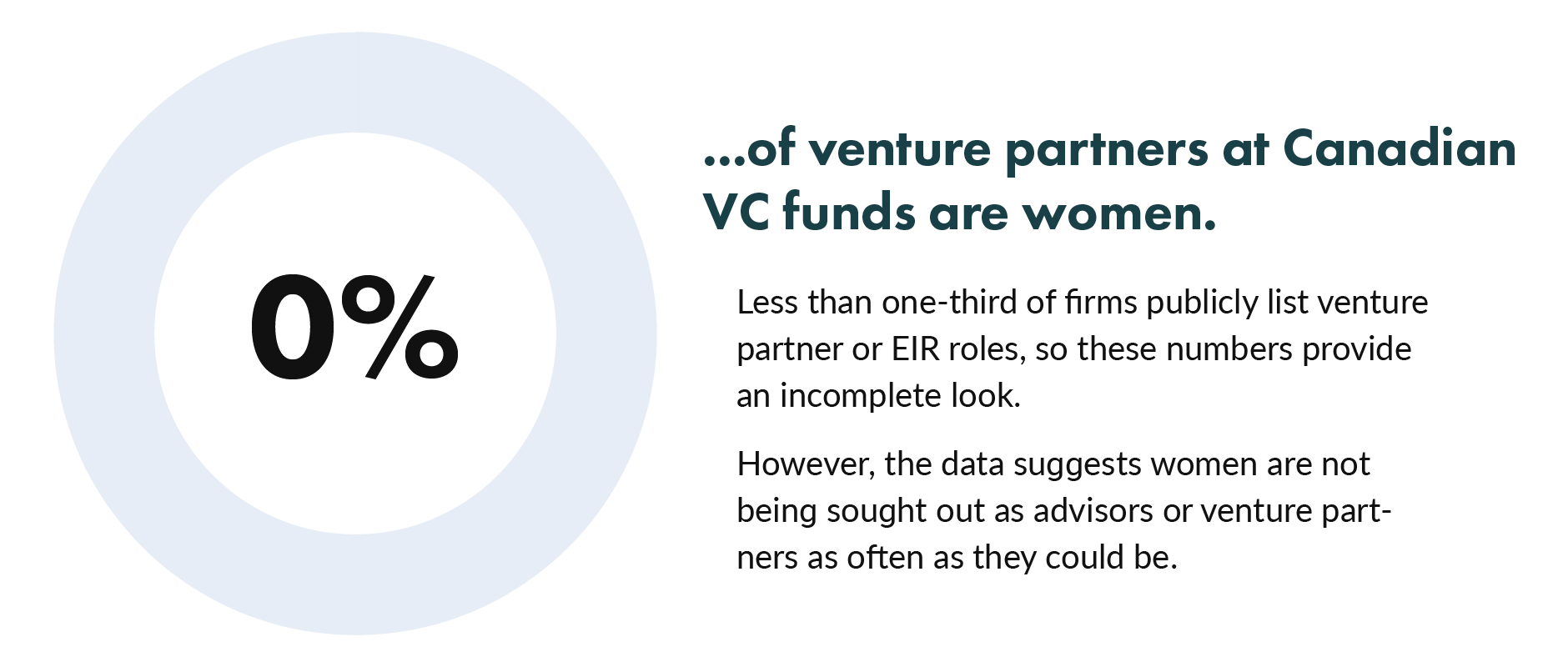

We have too few female venture partners.

A Venture Partner is someone that a VC firm brings on board to help them do investments and manage them, but is not a full and permanent member of the partnership.

Venture Partners are different from "Entrepreneurs In Residence" (EIRs) because they are expected to source multiple deals and manage them, whereas an EIR is often expected to source a single deal and then leave to run it.

Venture partners, advisors, and EIRs all improve deal flow, add expertise to investment committees, and better support portfolio companies – all without asking people to leave their current careers behind. But while 18% of EIRS and advisors are women,

Gender in Canada’s Angel Groups

Angel groups play a critical role in the mosaic of Canadian venture funding, provide financing to businesses that have tapped the resources available to them from families and friends, but may not yet be ready for venture capital funds. In 2017 alone, angel groups made 505 investments totalling $162.6 million.

Angel groups also play a key role in developing new investors by lowering the barrier to entry, providing access to education, investment opportunities, and a network of peers.

In Canada, the number of women accredited investors (and therefore potential angels) is growing quickly. In the last decade the total number of women earning at least $250,000 jumped by 49% – 3 times the 16% increase in men seen in the same time period. In 2015, women accounted for a record 23% of the top earners.

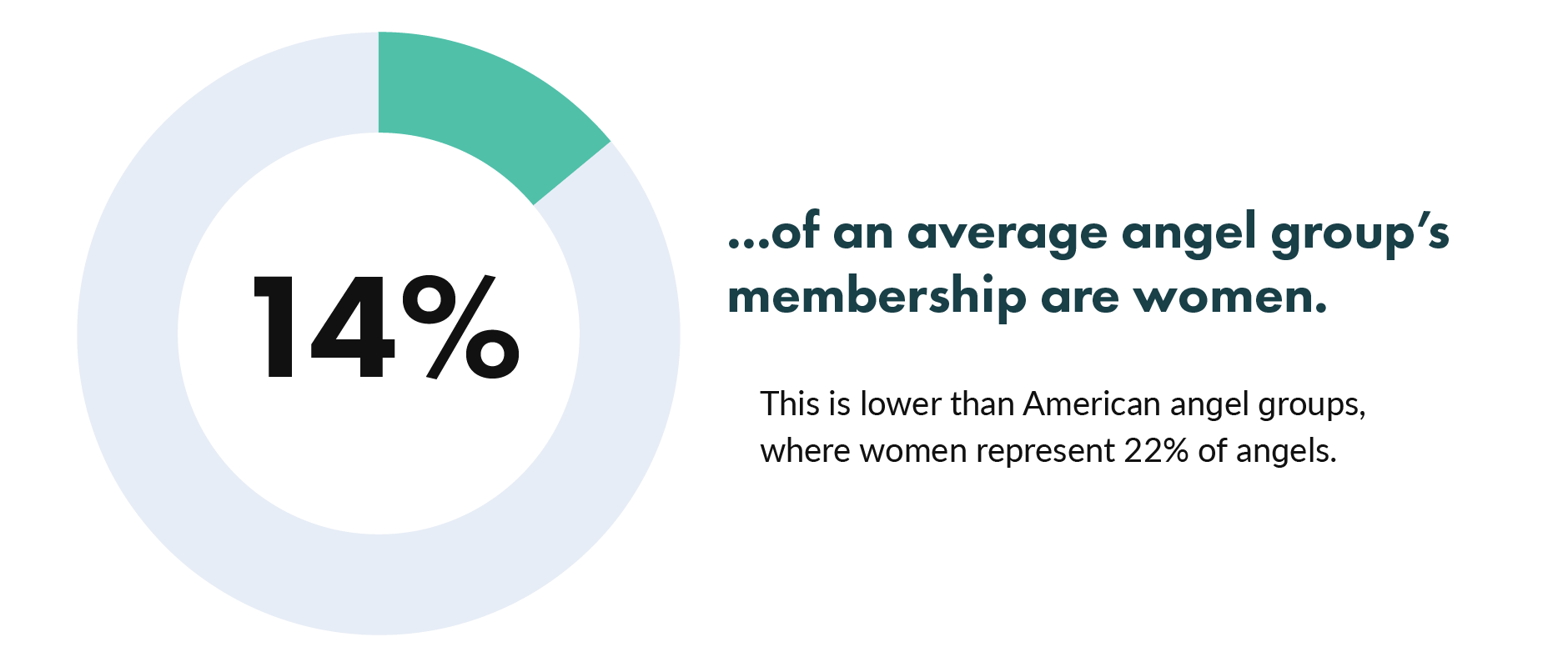

The membership of most angel groups range from 7% to 17% women.

The range of the makeup of angel groups is large – women comprised as much as 80% and as little as 0% of the angel groups examined.

While there are outliers, most angel groups have some women among their membership. The middle 50% of groups reported that between 7% and 17% of their membership are women.

Getting more women to become investors in early-stage startups will help increase the number of female leaders in the tech sector – and I believe it will also lead to higher returns.

- Michelle McCorkell, GTAN

What’s Next?

The capital, expertise, and networks of Canada’s leading women are being underutilized.

Currently, an overwhelming amount of the capital to be invested into startups in the coming years will be allocated with few or no women making those investment decisions. But it doesn’t have to be this way.

As the funders of Canada’s future, we have an obligation to understand where we’re starting from and to take steps – however big or small – to build a more inclusive industry. This report is just our first step, creating clarity through data. The next step is action.

Increasing the number of women angels and VC’s will help investors do better deals, will enable founders to build stronger companies, and strengthen Canada as a whole. As an industry, here are just a few actions we can take.

1/ Know our own numbers

We can’t manage what we don’t measure. The intent of this report is to provide a data-driven approach to benchmarking our industry - but this is just the beginning.

By regularly measuring and reporting on our own metrics, both angel groups and individual firms have an opportunity to understand how we’re doing, and to use that information to make better decisions.

2/ Encourage more women- at all levels - to pursue venture capital

Our industry needs to clarify pathways into venture, and actively encourage women at all levels to take the first step into venture capital. We can do this by creating more transparency into the venture capital industry, providing better investor education, building networks of peers and role models, and creating unique opportunities for women to learn about careers in venture capital.

In particular, recruiting technology and corporate executives for roles as venture partners will allow firms to unlock networks and expertise of women, all while introducing more women to the world of venture capital and building a path into VC.

3/ Unlock more of Canada’s potential women angels

The growing number of Canadian women who are accredited investors is not translating into increased participation in angel investing. By providing better investor education, creating stronger peer networks, increasing the visibility of women role models, and providing opportunities to develop hands-on experience, we can build the confidence and capacity of potential women angels.

4/ Cultivate talent within the industry

With each “step” up the career ladder – from analyst to associate/principal to partner, women’s representation is cut in half. Retaining this talent will be crucial to changing the makeup of Canada’s venture capital industry.

We need to clarify career pathways, provide opportunities for mentorship and sponsorship, and open doors to further education and hands-on experience for women working in VC today.

Join Female Funders in changing the face of angel investing

Angel Academy is an investor accelerator program for corporate and technology executives to learn the fundamentals of venture capital and, and to build a path to their first angel investment.